When Did Fair Labor Stardards Act Change

| |

| Long title | An Act to provide for the establishment of off-white labor standards in employments in and affecting interstate commerce, and for other purposes |

|---|---|

| Acronyms (colloquial) | FLSA |

| Enacted past | the 75th United States Congress |

| Effective | June 25, 1938 (1938-06-25) |

| Citations | |

| Public law | Pub.50. 75–718 |

| Statutes at Big | 52 Stat. 1060 through 52 Stat. 1070 (three pages) |

| Legislative history | |

| |

| United States Supreme Court cases | |

| List

| |

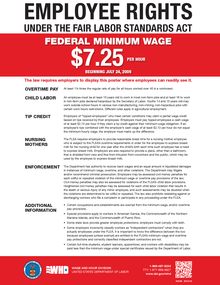

Department of Labor poster notifying employees of rights under the Fair Labor Standards Act

The Fair Labor Standards Act of 1938 29 U.S.C. § 203[one] (FLSA) is a United States labor law that creates the correct to a minimum wage, and "fourth dimension-and-a-half" overtime pay when people work over twoscore hours a calendar week.[2] [3] It also prohibits employment of minors in "oppressive child labor".[iv] It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the product of goods for commerce,[5] unless the employer can claim an exemption from coverage. The Deed was enacted by the 75th Congress and signed into law by President Franklin D. Roosevelt in 1938.

Practical application [edit]

The Fair Labor Standards Act applies to "employees who are engaged in interstate commerce or in the production of goods for commerce, or who are employed by an enterprise engaged in commerce or in the product of goods for commerce"[5] unless the employer can claim an exemption from coverage. Mostly, an employer with at least $500,000 of business or gross sales in a yr satisfies the commerce requirements of the FLSA,[6] and therefore that employer's workers are subject to the Off-white Labor Standards Act's protections if no other exemption applies. Several exemptions exist that salvage an employer from having to see the statutory minimum wage, overtime, and record-keeping requirements. The largest exceptions apply to the and then-called "white collar" exemptions that are applicable to professional person, authoritative and executive employees. Exemptions are narrowly construed, as an employer must bear witness that the employees fit "manifestly and unmistakably" inside the exemption's terms.

The Fair Labor Standards Human activity applies to "any individual employed by an employer" but not to independent contractors or volunteers because they are not considered "employees" under the FLSA.[7] Nonetheless, an employer cannot but exempt workers from the Fair Labor Standards Human activity past calling them independent contractors, and many employers have illegally and incorrectly classified their workers as independent contractors. Some employers similarly mislabel employees equally volunteers. Courts look at the "economic reality" of the relationship betwixt the putative employer and the worker to determine whether the worker is an independent contractor. Courts use a similar examination to determine whether a worker was concurrently employed by more than than one person or entity; unremarkably referred to every bit "joint employers". For instance, a farm worker may be considered jointly employed by a labor contractor (who is in charge of recruitment, transportation, payroll, and keeping track of hours) and a grower (who generally monitors the quality of the work performed, determines where to place workers, controls the volume of piece of work available, has quality control requirements, and has the ability to burn, discipline, or provide work instructions to workers).

In many instances, employers do not pay overtime properly for non-exempt jobs,[ clarification needed ] such equally not paying an employee for travel time between job sites, activities before or after their shifts, and preparation central to work activities.[viii] If an employee is entitled to overtime, the employer must pay them 1 and a half times their "regular rate of pay" for all hours they work over xl in the aforementioned work week.

Employees employed in a ministerial part by a religiously affiliated employer are not entitled to overtime under the act.[9] [10]

During World War 2, the Army-Navy "E" Honour for excellence in war production required maintaining the fair labor standards established under the Act.[11]

Tipping [edit]

Under the Fair Labor Standards Act, an employer has to pay each employee the minimum wage, unless the employee is "engaged in an occupation in which the employee customarily and regularly receives more than $30 a month in tips". If the employee's wage does non equal minimum wage, including tips, the employer must make upward the difference.[12] [13] However, the employee must be allowed to proceed all tips, either individually or through a tip pool.[fourteen] A tip pool may also incorporate but "employees who customarily and regularly receive tips".[15] "The phrase 'customarily and regularly' signifies a frequency which must be greater than occasional, simply which may exist less than constant."[sixteen]

While the classification of a job title is not dispositive, the task of "busboy" is explicitly validated for tip-pool inclusion by an authoritative source.[14] "A busboy performs an integral function of customer service without much straight interaction, but he does so in a manner visible to customers. ... Thus, for a service bartender to be validly included in a tip pool, he must meet this minimal threshold in a fashion sufficient to incentivize customers to 'customarily and regularly' tip in recognition" of his services (though he need not receive the tips directly).[17] [18]

Conflicts [edit]

Legislative and authoritative history [edit]

1938 Off-white Labor Standards Human action [edit]

The Fair Labor Standards Act was originally drafted in 1932 by Senator Hugo Black, whose proposal to require employers to adopt a thirty-hour workweek met trigger-happy resistance.[22]

In 1938, a revised version of Black's proposal was passed. The revised version was instrumentally supported past a number of notable people, including Frances Perkins, Clara Mortenson Beyer from the Bureau of Labor Standards within the The states Section of Labor, as well as Congresswoman Mary T. Norton.[23] The revised proposal adopted an eight-hour day and a 40-hour workweek and immune workers to earn wage for an extra four hours of overtime too.[22] Co-ordinate to the human action, workers must exist paid minimum wage and overtime pay must be 1-and-a-half times regular pay. Children nether eighteen cannot practise certain dangerous jobs, and children under sixteen cannot work in manufacturing or mining or during school hours.[24] [4] Though it did non cover executives, seasonal employees, and some other groups, the Fair Labor Standards Deed gave raises to 700,000 workers, and US President Franklin Roosevelt chosen it the most important piece of New Bargain legislation since the Social Security Act of 1935.[25]

1947 Portal-to-Portal Act [edit]

In 1946, the US Supreme Courtroom ruled in Anderson five. Mt. Clemens Pottery Co. that preliminary piece of work activities controlled by the employer and performed entirely for the employer's benefit are properly included as working time under the FLSA.

In response, Congress passed the 1947 Portal-to-Portal Human activity, which narrowed the Supreme Court's decision.[26] It specified exactly what type of fourth dimension was considered compensable work fourth dimension. In full general, as long as an employee is engaging in activities that benefit the employer, regardless of when they are performed, the employer has an obligation to pay the employee for that time. The deed also specified that travel to and from the workplace was a normal incident of employment and should not exist considered paid working time.

The act stated that employees had two years of performing the work to file a lawsuit for uncompensated time.[26] Upon signing the human action, President Harry Truman urged Congress to increase the minimum wage from 40 cents per 60 minutes to 65 cents per hour.[26]

1949 Fair Labor Standards Amendment [edit]

The full event of the FLSA of 1938 was postponed by the wartime aggrandizement of the 1940s, which increased (nominal) wages to above the level specified in the Act. On Oct 26, 1949, President Truman signed the Off-white Labor Standards Amendment Act of 1949 (ch. 736, Pub.L. 81–393, 63 Stat. 910, 29 U.Due south.C. § 201).[27]

The act defined an employee's "regular rate" of pay for purposes of computation of overtime pay.[28] The act specified that employees were covered by the Fair Labor Standards Act if they are "straight essential" to product of goods for interstate commerce.[28] The act increased the minimum wage from forty cents to 75 cents per hour, effective January 24, 1950.[28] The deed prohibited oppressive kid labor in commerce or in the production of appurtenances for commerce.[28] The act also included a few new exemptions for special worker classes.

1955 amendment [edit]

In 1955, President Eisenhower urged Congress to amend the FLSA in club to increase the number of employees who are covered by minimum wage laws and to increase the minimum wage itself to xc cents per hour.[29] [thirty] At the time, retail workers and services workers were not covered by minimum wage laws.[29]

Congress passed an amendment to the FLSA, and President Eisenhower signed it on August 12, 1955.[30] The amendment increased the minimum wage from 75¢ per hour to $i per hour, effective March 1, 1956.[30] Despite a push button by some members of Congress, retail workers, service workers, agronomical workers, and structure workers were still not required to be paid at least the minimum wage.[30]

1961 amendment [edit]

The 1961 amendment added another method of determining a type of coverage chosen enterprise coverage. Enterprise coverage applies merely when the business is involved in interstate commerce and its gross annual business volume is a minimum of $500,000. All employees working for "enterprises" are so covered by the FLSA if the individual firms of the "enterprise take a revenue greater than $500,000 per twelvemonth".[31] Nether the original 1938 Act, a worker whose work is in the channels of interstate commerce is covered as an private. "Interstate commerce" is interpreted and so broadly that most piece of work is included, such as ordering, loading, or using supplies from out of country, accepting payments from customers based on credit cards issued by out-of-state banks, and so on.

The 1961 subpoena too specified that coverage is automatic for schools, hospitals, nursing homes, or other residential care facilities. Coverage is also automated for all governmental entities at whatsoever level of government, no matter the size. Coverage does not utilize to certain entities not organized for business, such as churches and charitable institutions. The minimum wage level was again increased to $i.25 per hour. What could be considered a wage was specifically divers, and entitlement to sue for back wages was granted.

1963 Equal Pay Human action [edit]

The Equal Pay Act of 1963 was enacted to meliorate the FLSA and make it illegal to pay some workers lower wages than others strictly on the basis on their sexual activity.[32] [33] Information technology is often summed upwardly with the phrase "equal pay for equal work". The Equal Pay Act allows unequal pay for equal work only when the employer sets wages pursuant to a seniority system, a merit organization, a arrangement that measures earnings by quantity or quality of product, or other factors exterior of sex. For the showtime nine years of the EPA, the requirement of equal pay for equal work did not extend to persons employed in an executive, administrative or professional capacity, or as an outside salesperson. Therefore, the EPA exempted white-collar women from the protection of equal pay for equal work. In 1972, Congress enacted the Education Amendments of 1972, which amended the FLSA to aggrandize the coverage of the EPA to these employees, by excluding the EPA from the professional workers exemption of the FLSA.

1966 amendment [edit]

The 1966 amendment expanded coverage to some farm workers and increased the minimum wage to $1.threescore per hour in stages. The 1966 Off-white Labor Standards Act amendment too gave federal employees coverage for the showtime time.[34]

A 2021 written report on the effects of the 1966 extension, which raised the minimum wage in several economic sectors, institute that the minimum wages increases led to a sharp increase in earnings without any adverse aggregate furnishings on employment. The legislation as well substantially reduced the racial wage gap.[35]

1967 Age Discrimination in Employment Act [edit]

The Age Discrimination in Employment Human action of 1967 (ADEA) prohibited employment discrimination confronting persons twoscore years of age or older. Some older workers were being denied health benefits based on their age and denied training opportunities prior to the passage of the ADEA. The act applies simply to businesses employing more than than twenty workers.

1974 Fair Labor Standards Amendments [edit]

The 1974 amendment expanded coverage to include other country and local government employees that were non previously covered. Domestic workers also became covered and the minimum wage was increased to $2.30 per 60 minutes in stages.[34]

1977 Fair Labor Standards Amendments [edit]

The 1977 amendment increased the minimum wage in yearly increments through 1981 to $3.35 an 60 minutes.[34] Changes were made involving tipped employees and the tip credit. Partial overtime exemption was repealed in stages for certain hotel, motel, and eatery employees.

1983 Migrant and Seasonal Agronomical Worker Protection Human action [edit]

The Migrant and Seasonal Agricultural Worker Protection Human activity (MSPA), enacted in 1983, was designed to provide migrant and seasonal farm workers with protections concerning pay, working conditions, and work-related conditions to require farm labor contractors to register with the Us Department of Labor and clinch necessary protections for farm workers, agronomical associations, and agricultural employers.

1985 Off-white Labor Standards Amendments [edit]

An amendment permitted state and local government employers to compensate their employees' overtime hours with paid time away from work in lieu of overtime pay.[36] Paid fourth dimension off must exist given at the rate of one and one-half hours for each hr of employment for which overtime compensation would exist required by the Fair Labor Standards Act.[36] Other employers may not compensate employees with paid fourth dimension off in lieu of overtime pay.[36]

The amendment exempted country and local governments from paying overtime for special detail work performed past fire-protection, constabulary-enforcement, and prison-security employees.[36] The amendment exempted country and local governments from paying overtime to employees working in a substantially different capacity from the employee'due south regular total-time employment on a sporadic ground.[36]

The amendment stated that individuals who volunteer to perform services for a state or local government bureau are not covered by the Off-white Labor Standards Act if the individual receives no compensation or nominal compensation.[36]

The amendment stated that country and local legislative employees, other than legislative library employees, are not covered by the Off-white Labor Standards Act.[36]

1986 Amendment [edit]

In 1986, the Fair Labor Standards Act was amended to permit the United States Secretary of Labor to provide special certificates to allow an employer to pay less than the minimum wage to individuals whose earning or productive capacity is impaired by age, physical or mental deficiency, or injury.[37] These employees must still be paid wages that are related to the private'south productivity and commensurate with those paid to similarly located and employed nonhandicapped workers.[37] However, paying workers with disabilities less than the minimum wage was outlawed in New Hampshire in 2015, in Maryland in 2016, and in Alaska in 2018.[38]

Section 14(c) [edit]

Section fourteen(c) of the Off-white Labor Standards Act states that with the approval of the Department of Labor's Wage and Hr Division (WHD) certain employers can pay employees with disabilities below the minimum wage.[39] In order for the subminimum wage to apply, the disability of the worker must straight touch their productivity in their given position. The employer must show that the piece of work of an employee with a disability is less productive than the standard set up for employees without disabilities. If approved by the WHD, the rate of pay for the worker with a disability can correlate to their productivity in comparing to workers without disabilities.[twoscore] Every 6th months at a minimum, employers certified under Section 14(c) must review the special minimum wage of their hourly employees. Annually, Section 14(c) employers must besides adjust the rate of pay workers receiving special minimum wages to remain comparable to that of employees without disabilities.[41] These requirements of subminimum wage review by the employers were added to Department fourteen(c) through a 1986 amendment.[42] The intention of the section is to enable higher employment for people with disabilities. The concern with enforcing minimum wage was that there would be a decrease in the task opportunities for workers with disabilities, so Section 14(c) is to be utilized only as needed to offset whatever opportunity loss.[41]

The majority of Section 14(c) workers are employed through work centers, just these individuals also work through businesses, schools, and hospitals. As of 2001, 424,000 employees with disabilities were receiving the subminimum wages through five,600 employers nether Section xiv(c).[39] Employers paid over l% of their workers with disabilities $2.l per hour or less due to reduced productivity caused past a disability.[39] There are several proposed bills that would repeal and eventually phase out Section xiv(c) certifications such equally H.R. 873[43] or H.R. 582 (Raise the Wage Act) which was passed past the Firm of Representatives in July 2019.[44]

[edit]

The Department of Defense Authorisation Deed of 1986 repealed the viii-hour daily overtime requirements on all federal contracts.

1989 Off-white Labor Standards Amendments [edit]

In 1989, Senator Edward M. Kennedy introduced a bill to increment the minimum wage from $three.35 per hour to $4.55 per hour in stages.[45] Secretarial assistant of Labor Elizabeth Dole supported increasing the minimum wage to $four.25 per hour along with allowing a minimum wage of $iii.35 an hour for new employees' kickoff ninety days of employment for an employer.[45] Secretary Dole said that President George H. W. Bush would veto any bill increasing the minimum wage to more than $4.25 per hr.[46]

By a vote of 248 to 171, the Firm of Representatives approved a beak to increase the minimum wage to $4.55 per hour in stages over a 2-yr period.[47] The bill also immune employers to pay new employees at least 85 percent of the minimum wage during the first sixty days of employment of a newly hired employee with no previous employment.[47] The bill also increased the exemption from minimum wage law for small businesses from $362,500 to $500,000 of annual sales.[48] By a vote of 61 to 39, the Senate approved a nib to increase the minimum wage to $4.55 per hour.[49] President Bush vetoed the nib,[50] calling the increase "excessive".[51] The House of Representatives unsuccessfully tried to override the veto, voting 247 to 178 to override, 37 votes short.[52]

By a vote of 382 to 37, the Firm of Representatives approved a revised bill that would increment the minimum wage to $3.fourscore per hour equally of Apr 1990, and $4.25 per hour as of April 1, 1991.[53] The bill would allow a lower minimum wage for employees who are less than 20 years one-time.[53] The bill eliminated dissimilar minimum wages for retail and non-retail businesses.[54] [55] The adjacent week, the Senate approved the pecker by a vote of 89 to 8.[56] Senators Orrin Hatch, Steve Symms, and Phil Gramm were unsuccessful at passing minimum-wage exemptions for small businesses and farmers using migrant or seasonal workers.[56] President Bush-league signed the bill two weeks later.[57]

1996 Small Business Job Protection Act [edit]

The 1996 amendment increased the minimum wage to $v.fifteen an hr. However, the Small Business concern Job Protection Act of 1996 (PL 104-188), which provided the minimum-wage increment, too detached tipped employees from future minimum-wage increases.[58]

2004 rule change [edit]

On Baronial 23, 2004, controversial changes to exemptions from the FLSA's minimum wage and overtime requirements went into effect, making substantial modifications to the definition of an "exempt" employee. Low-level working supervisors throughout American industries were reclassified as "executives" and lost overtime rights. The changes were sought by business concern interests, which claimed that the laws needed description and that few workers would be affected. The Bush administration called the new regulations "FairPay". Even so, other organizations, such as the AFL-CIO, claimed the changes would make millions of additional workers ineligible to obtain relief under the FLSA for overtime pay. Attempts in Congress to overturn the new regulations were unsuccessful.

Conversely, some low-level employees (particularly administrative-support staff) that had previously been classified as exempt were now reclassified every bit non-exempt. Although such employees work in positions begetting titles previously used to determine exempt condition (such as "executive assistant"), the 2004 amendment to the FLSA now requires that an exemption must be predicated upon actual job office and non job title. Employees with job titles that previously allowed exemption simply whose chore descriptions did non include managerial functions were now reclassified from exempt to non-exempt.

2007 Off-white Minimum Wage Act [edit]

On May 25, 2007, President Bush signed into law a supplemental appropriation bill (H.R. 2206), which contains the Fair Minimum Wage Act of 2007.[59] This provision amended the FLSA to provide for the increment of the federal minimum wage by an incremental plan, culminating in a minimum wage of $vii.25 per hour by July 24, 2009. Further, American territories including American Samoa and Puerto Rico were to adopt the mainland minimum wage in a serial of incremental increases.

2010 Patient Protection and Affordable Intendance Deed [edit]

Department 4207 of the Patient Protection and Affordable Care Act (H.R. 3590) apology Department 7 to add a "break time for nursing mothers" provision. It specifies that employers shall provide suspension time for nursing mothers to express milk and that "a place, other than a bath, that is shielded from view and free from intrusion from coworkers and the public" should exist available for employees to express milk.[lx]

2019 rule modify [edit]

On September 27, 2019, the Department of Labor released a dominion setting the salary level or amount test at $684 per calendar week (equivalent to $35,568 per year) in order for an employee to qualify as an FLSA-exempt executive employee, administrative employee, and professional person employee.[61] [62] [63] In order to authorize as a highly compensated employee, the total annual compensation test was set at $107,432.[61] [62] [63] When the Department of Labor had determined the total annual bounty, it based information technology on the eightieth percentile of weekly earnings for total-time salaried employees in the United States.[61] [62] [63]

Proposed amendments [edit]

2009/2013 Paid Holiday Act [edit]

In May 2013, representative Alan Grayson proposed this deed that would give employees paid vacation leave. It was a retry of his original human activity in 2009.

2014 Minimum Wage Fairness Human action [edit]

In April 2014, the United States Senate debated the Minimum Wage Fairness Act (S. 1737; 113th Congress). The bill would have amended the Off-white Labor Standards Act of 1938 (FLSA) to increase the federal minimum wage for employees to $10.x per hour over the form of a 2-twelvemonth period.[64] The nib was strongly supported by President Barack Obama and many of the Democratic senators, but strongly opposed by Republicans in the Senate and House.[65] [66] [67]

2015 Healthy Families Act [edit]

In January 2015, President Barack Obama asked Congress to pass the Healthy Families Human activity nether which employers would be immune to give employees one hr of paid sick leave for every 30 hours they work upward. This applies for up to seven days or 56 hours of paid ill leave annually instead of paying overtime to the employees. The bill, every bit proposed, would have applied to employers with fifteen or more than employees for employees as defined in the Fair Labor Standards Deed.[68]

2015 proposed rulemaking [edit]

On July six, 2015, the Department of Labor published a Discover of Proposed Rulemaking,[69] based on a 2014 presidential memorandum signed by President Barack Obama directing the Department of Labor to update the regulations defining which white-collar workers are protected by the FLSA's minimum wage and overtime standards.[lxx] On May 18, 2016, the concluding version of the rule was published,[70] which would require that employees earning a salary of less than $913 per week would be paid overtime, effective Dec 1, 2016,[lxx] and the threshold would exist automatically adjusted every three years, beginning January ane, 2020.[seventy]

On November 23, 2016, a United States District approximate imposed an injunction, temporarily stopping the dominion's enforcement nationwide, in guild to accept time to decide whether the Department of Labor had the dominance to effect the regulation.[71] When the Trump assistants took power in January 2017 they opted not to defend the dominion in court, leading to a summary sentence on Baronial 31 that the rule was invalid because the threshold was so high that it made the duties test irrelevant, and considering the automatic adjustments provided past the rule were unlawful.[72]

2016 Wage Theft Prevention and Wage Recovery Act [edit]

In September 2016, Democratic members of the Usa House and Senate introduced the Wage Theft Prevention and Wage Recovery Human activity. Information technology would have increased employer liability under FLSA suits to the amount promised past the employer, rather than the minimum wage, prohibit pre-dispute mediation agreements from precluding a merits of wage theft from court, make it possible to bring FLSA class action suits without the individual consent of workers who had their wages stolen, create automatic financial penalties for violations and create a discretionary ability for the Section of Labor to refer the violators to the Section of Justice for prosecution. The nib did not brand it out of commission in either the Business firm or the Senate.[73]

Encounter also [edit]

- United States labor police force

- Timeline of children's rights in the United States

- Frank Tater

- Second Nib of Rights

- Employment discrimination law in the United States

- Tennessee Coal, Iron & Railroad Co. 5. Muscoda Local No. 123

- Garcia 5. San Antonio Metropolitan Transit Authority

- Living wage

- Minimum wage in the United States

- List of U.S. minimum wages

- Maximum wage

- Wage slave

- Blue police force

References [edit]

- ^ Pub.L. 75–718, ch. 676, 52 Stat. 1060, June 25, 1938

- ^ Samuel, Howard (December 2000). "Troubled passage: the labor movement and the Fair Labor Standards Human action" (PDF). Monthly Labor Review. United States Agency of Labor Statistics. Retrieved Baronial xx, 2014.

- ^ a b See and 29 U.S.C. § 212.

- ^ a b "Fair Labor Standards Act - FLSA - 29 U.Southward. Code Affiliate eight". finduslaw.com.

- ^ "Federal Overtime Rules FAQ". dol.gov. Department of Labor. 2016. Archived from the original on October 27, 2016.

- ^ "Fair Labor Standards Deed - FLSA - 29 U.Due south. Code Affiliate eight". finduslaw.com.

- ^ "Updated Federal Overtime Law means tracking fourth dimension". SwipeClock. 2016.

- ^ "Because A Kosher Supervisor Is Employed In A Ministerial Office By A Religiously Affiliated Employer He Falls Within FLSA'due south 'Ministerial Exception'", Hr Comply, Ceridian, April 8, 2004

- ^ "Shaliehsabou v. Hebrew Home of Greater Washington, Incorporated" (PDF), United States District Courtroom of Appeals for the 4th Excursion, April two, 2004, archived from the original (PDF) on May 13, 2006, retrieved April 26, 2012

- ^ "Army-Navy E Award - Miscellaneous Documents and Images". The Navy Department Library . Retrieved January 21, 2014.

- ^ Lore, Michael. "Overtime Qualification and Exemption FAQs". Overtime FAQ. Michael D. Lore, P.C. Archived from the original on December 24, 2014. Retrieved November 10, 2014.

If an employer elects to use the tip credit provision, information technology must inform the employee in advance and must exist able to show that the employee receives at least the minimum wage when direct wages and the tip credit allowance are combined. If an employee's tips combined with the employer's direct wages do non equal the minimum hourly wage, the employer must make up the deviation.

- ^ "Minimum Wage". U.S. Section of Labor - Wage and Hour Sectionalisation (WHD). July 24, 2009.

- ^ a b § 531.54 Tip pooling. :: Part 531-WAGE PAYMENTS Nether THE FAIR LABOR STANDARDS ACT OF 1938 :: Affiliate V-WAGE AND 60 minutes DIVISION, Section OF LABOR :: Title 29 - Labor :: Code of Federal Regulations :: Regulations :: Law :: Justia. Law.justia.com. Retrieved on 2013-08-12.

- ^ Lore, Michael. "Overtime Qualification and Exemption FAQs". Overtime FAQ. Michael D. Lore, P.C. Archived from the original on December 24, 2014. Retrieved Nov 10, 2014.

Employees must retain all of their tips, except to the extent that they participate in a valid tip pooling or sharing system. A tip puddle can often exist invalidated if tips are shared with managers, dishwashers, cooks, chefs or others who are non entitled to share in tips.

- ^ "Receiving the minimum amount 'customarily and regularly'. - Title 29 - Labor - Lawmaking of Federal Regulations - LII / Legal Data Plant". Police force.cornell.edu . Retrieved August 12, 2013.

29 CFR 531.57

- ^ "VIRGINIA BARRERA Plaintiff, v. MTC, INC. d/b/a MI TIERRA CAFÉ AND BAKERY d/b/a LA MARGARITA Eating house & OYSTER BAR, and d/b/a RESTAURANTE PICO DE GALLO, Us Commune COURT FOR THE WESTERN Commune OF TEXAS SAN ANTONIO Partition" (PDF).

- ^ "Texas Court Holds 'Service Bartenders' May Be Eligible To Participate In A Mandatory Tip Pool Under FLSA]. Wage and Hour Police Update". August 22, 2011. Retrieved August 12, 2013.

- ^ "FRED Graph". U.S. Department of Labor.

- ^ "Federal Minimum Hourly Wage for Nonfarm Workers for the The states". October 1938.

- ^ "Inflation adjusted". Consumer Price Index for All Urban Consumers: All Items in U.South. City Average (CPIAUCSL). Federal Reserve Economical Data (FRED)). Jan 1947. Retrieved February eight, 2020.

- ^ a b Hugo L. Black. "Hugo Fifty. Black". Encyclopedia of Alabama. Archived from the original on November 5, 2011.

- ^ Ware, Susan. (2004). Notable American Women: Completing the Twentieth Century. Beyer, Clara Mortenson.

- ^ Bolander, Donald O. (1990). The New Webster'due south Library of Practical Information: Family Legal Guide. Lexicon Publications. p. 51. ISBN0-7172-4500-4.

- ^ Samuel, Howard D. (December 2000). "Troubled passage: the labor movement and the Fair Labor Standards Act" (PDF). Monthly Labor Review. BLS. pp. 32–37.

- ^ a b c Starks, Louis. "Gives His Reasons: Truman Approves Portal Adapt Bar". The New York Times. May 15, 1947. p. 1.

- ^ Leviero, Anthony. "Truman Signs Pay Ascent Bill; Bulldoze for $1 Minimum Starts: Truman Signs Minimum Wage Neb; Bulldoze for Ascent to $1 an Hr Starts". The New York Times. Oct 27, 1949. p. 1.

- ^ a b c d Crowther, Rodney. "Truman Signs Minimum Pay Legislation: 75-Cent Wage Base Law To Become Effective Later on 90 Days". The Baltimore Lord's day. October 27, 1949. p. 2.

- ^ a b Loftus, Joseph A. "Eisenhower Urges Wage Law Spread: Subordinates Minimum Pay Increase to Coverage for More Workers". The New York Times. April 28, 1955. p. 23.

- ^ a b c d Knighton, William, Jr. "President Signs Beak Setting Minimum Pay At $ane An Hr". The Baltimore Sunday. Baronial 13, 1955. p. 4.

- ^ "Fact Canvas #14: Coverage Nether the Fair Labor Standards Act (FLSA)". U.South. Department of Labor Wage and Hour Section . Retrieved September vii, 2010.

- ^ "Equal Pay Human activity of 1963". U.Due south. Equal Employment Opportunity Commission.

- ^ "The Equal Pay Act Turns twoscore". U.Due south. Equal Employment Opportunity Commission. Archived from the original on June 26, 2012.

- ^ a b c "History of Changes to the Minimum Wage Law". United states Section of Labor . Retrieved January iii, 2017.

- ^ Derenoncourt, Ellora; Montialoux, Claire (December 22, 2020). "Minimum Wages and Racial Inequality". The Quarterly Periodical of Economic science. 136 (one): 169–228. doi:10.1093/qje/qjaa031. ISSN 0033-5533.

- ^ a b c d e f g "Southward.1570 - Fair Labor Standards Amendments of 1985". United states of america Congress. November 13, 1985.

- ^ a b "South.2884 – 99th Congress (1985-1986)". United states Congress. October 16, 1986.

- ^ "Alaska bars employers from paying disabled workers less than minimum wage". Vocalism. February 23, 2018. Retrieved December 12, 2019.

- ^ a b c "Special Minimum Wage Program: Centers Offering Employment and Back up Services to Workers With Disabilities, But Labor Should Better Oversight" (PDF). U.Southward. Full general Accounting Office. September 4, 2001. Retrieved Baronial 24, 2020.

- ^ "Part 525 – Employment Of Workers with Disabilities Under Special Certificates". Lawmaking of Federal Regulations. National Archives. August x, 1989. Retrieved August 24, 2020.

- ^ a b "Department 214 of the FLSA" (PDF). U.South. Government Publishing Office.

- ^ Crawford, Matthew; Goodman, Joshua (2013). "Below the Minimum: A Disquisitional Review of the 14(c) Wage Program for Employees with Disabilities". Hofstra Labor & Employment Law Journal. 30.

- ^ "H.R. 873" (PDF). U.Southward. Authorities Publishing Part. January 30, 2019. Retrieved August 24, 2020.

- ^ "H.R. 582". Congress.gov. July 18, 2019. Retrieved August 24, 2020.

- ^ a b "Secy. Dole Asks $4.25 Minimum Pay". Los Angeles Times. March 3, 1989. p. three.

- ^ "Dole warns of Bush-league veto if wage constabulary tops $iv.25". The Baltimore Sun. Associated Press. March 4, 1989. p. 15B.

- ^ a b Rasky, Susan F. "House Votes Rise in Minimum Wage: Democrats Meet the Wage Issue as a Exam of Bush-league Pledges". The New York Times. March 24, 1989. p. A1.

- ^ Hawkins, Augustus F. "Wage Hike Leaps First Hurdle". Michigan Denizen (Highland Park, Michigan). April 22, 1989. p. 5.

- ^ Pine, Art. "Senate Approves Increase in Minimum Wage to $4.55". Los Angeles Times. April 12, 1989. p. 1.

- ^ "Bush Vetoed Minimum Wage Increase to $four.55". Los Angeles Times. June 13, 1989. p. 1.

- ^ Devroy, Ann; Dewar, Helen. "Bush Vetoes 'Excessive' Rise in Minimum Wage". The Washington Mail service. June 14, 1989. p. A1.

- ^ Rasky, Susan F. "Veto Wage Neb Withstands Vote: House and Senate Democrats Vow to Seek Compromise on Minimum-Pay Rise". The New York Times. June 15, 1989. p. A21.

- ^ a b Eaton, William J. "House Votes $four.25 Minimum Wage Legislation: The compromise is sent to the Senate. Bush may sign it in fourth dimension for Thanksgiving". Los Angeles Times. November ii, 1989. p. 24.

- ^ "Wages: Subminimum Wage". U.S. Department of Labor . Retrieved September vii, 2010.

- ^ "Fact Sail #32: Youth Minimum Wage – Fair Labor Standards Act". U.S. Department of Labor Wage and 60 minutes Sectionalization . Retrieved September 7, 2010.

- ^ a b Karr, Albert R. "Senate Passes Bill on Wage Flooring: Bush-league Seen Signing". The Wall Street Journal. November nine, 1989. p. 1.

- ^ "Bush-league Signs Minimum Wage Police". Los Angeles Times. Nov 17, 1989. p. 2.

- ^ "Chapter 8 – Fair Labor Standards". U.S. Code. Archived from the original on October 9, 2010. Retrieved September 7, 2010.

- ^ Pub.Fifty. 110–28 (text) (PDF), Championship VIII

- ^ "Break Time for Nursing Mothers". United states Department of Labor . Retrieved Jan 3, 2017.

- ^ a b c "RIN 1235–AA20: Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales and Calculator Employees (Final Rule)". Wage and Hour Partition, U.s.a. Section of Labor. Federal Annals. Vol. 84. No. 188. September 27, 2019.

- ^ a b c Robinson, Jr., Alfred B. (September 24, 2019). "Finally, the Final Part 541 Rule: $35,568 Is the New Bacon Threshold for Exempt Employees". National Law Review.

- ^ a b c Nagele-Piazza, Lisa (September 24, 2019). "New Overtime Rule Raises Salary Cut-Off to $35,568". Social club for Human Resources Direction.

- ^ "S. 1737 - Summary". United States Congress. April two, 2014. Retrieved April 8, 2014.

- ^ Sink, Justin (Apr two, 2014). "Obama: Congress has 'clear choice' on minimum wage". The Loma . Retrieved April nine, 2014.

- ^ Bolton, Alexander (April eight, 2014). "Reid punts on minimum-wage hike". The Hill . Retrieved April nine, 2014.

- ^ Bolton, Alexander (April four, 2014). "Centrist Republicans cool to minimum wage hike compromise". The Hill . Retrieved April 9, 2014.

- ^ Parker, Katharine (January 15, 2015). "No Finish In Sight For Moving ridge of Paid Family and Sick Leave Laws". The National Police force Review. Proskauer Rose LLP. Retrieved Feb 28, 2015.

- ^ "fourscore FR 38515 - Defining and Delimiting the Exemptions for Executive, Authoritative, Professional, Outside Sales and Calculator Employees". govinfo. U.S. Authorities Publishing Office. July vi, 2015. Retrieved March x, 2022.

- ^ a b c d "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales and Computer Employees under the Fair Labor Standards Human action" Archived November vii, 2016, at the Wayback Motorcar. Wage and Hour Partition. United States Section of Labor. May 18, 2016.

- ^ Morton, Victor; Boyer, Dave. "Federal judge blocks Obama overtime pay rule". The Washington Times. November 23, 2016.

- ^ Miller, Stephen; Nagele-Piazza, Lisa (Baronial 31, 2017). "Federal Judge Strikes Down Obama DOL'southward Overtime Dominion". SHRM . Retrieved March 10, 2022.

- ^ "H.R.4763 – 2016 Wage Theft Prevention and Wage Recovery Human activity". September 19, 2016.

Notes [edit]

- Burkhauser, Richard 5.; Finegan, T. Aldrich (1989). "The Minimum Wage and the Poor: The End of a Relationship". Journal of Policy Assay and Management. Clan for Public Policy Analysis and Management. 8 (ane): 53–71. doi:10.2307/3324424. JSTOR 3324424.

- Grossman, J. (1978). "Fair Labor Standards Human action of 1938: Maximum Struggle for a Minimum Wage". Monthly Labor Review. 101 (6): 22–xxx. PMID 10307721.

- Lechner, Jay P. (2005). "The New FLSA White-Collar Regulations—Analysis of Changes". Florida Bar Journal. 79 (ii): 20. Archived from the original on March thirteen, 2007.

- Mettler, Suzanne B. (1994). "Federalism, Gender, & the Fair Labor Standards Act of 1938". Polity. Palgrave Macmillan Journals. 26 (4): 635–654. doi:10.2307/3235098. JSTOR 3235098. S2CID 155777199.

External links [edit]

- "Fair Labor Standards Deed Of 1938, Every bit Amended" (PDF). Wage and 60 minutes Segmentation. United States Department of Labor. May 2011. Retrieved Nov 23, 2016.

- "Wage and Hr Law: Repast and Rest Periods". Archived from the original on November 21, 2010.

- "Purchasing power of minimum wage from 1958 to 2002" (PDF). fiscalpolicy.org.

- "AFL-CIO, American Federation of Labor - Congress of Industrial Organizations".

- "Minimum wage". aflcio.org. Archived from the original on September 3, 2005.

- "2004 changes in overtime regulations" (PDF). aflcio.org. Archived from the original (PDF) on September 10, 2008.

- "Average U.Due south. farm and non-subcontract wages compared to the minimum wage (1981 - 2004)". usda.gov. Archived from the original on September 26, 2006.

- "Affect of Proposed Minimum-Wage Increase on Depression-income Families" (PDF). Centre for Economic and Policy Research. Archived from the original (PDF) on December 19, 2005.

- "FLSA Decisions". Overtime Law Web log.

- "Association of Community Organizations for Reform Now".

- "Center for Policy Alternatives". stateaction.org. Archived from the original on March 27, 2006.

- "Minimum Wage". The Economic Policy Establish. Archived from the original on January 21, 2009.

- "Analysis of 2004 modify in overtime regulations". epinet.org. Archived from the original on December 1, 2007.

- "Floridians for All".

- "Raising the National Minimum Wage: Information, Opinion, Enquiry".

- "Minimum wage". workplacefairness.org.

- "Overtime compensation". workplacefairness.org.

- "Concern & Legal Reports". Archived from the original on March xiii, 2007.

- "Written report Finds Many Twenty-four hour period Laborers Exploited". Archived from the original on November 4, 2019.

- "Supreme Court Clarifies Wage and Hour Constabulary". Archived from the original on November 4, 2019.

- "Exempt and Non-Exempt Employees Definition".

- "Fair Labor Standards Deed - FLSA". 29 U.Due south. Code Affiliate 8. Archived from the original on December 8, 2008.

- "Calculate Pay for Tipped and Not-Tipped Employees per State, Including Tip-Credit". WaitressCalc 2012. Archived from the original on Feb 5, 2013.

- "FLSA comp fourth dimension".

- "Wage-Police Enforcer: 'Jaw-Dropping' Violations Demand Tougher Action". The Wall Street Journal. December thirty, 2014.

When Did Fair Labor Stardards Act Change,

Source: https://en.wikipedia.org/wiki/Fair_Labor_Standards_Act_of_1938#:~:text=1955%20amendment,-In%201955%2C%20President&text=Congress%20passed%20an%20amendment%20to,%2C%20effective%20March%201%2C%201956.

Posted by: stephensbeforpeo.blogspot.com

0 Response to "When Did Fair Labor Stardards Act Change"

Post a Comment